However, this exemption phases out for high-income taxpayers. To prevent low- and middle-income taxpayers from being subject to the AMT, taxpayers are allowed to exempt a significant amount of their income from AMTI. The AMT uses an alternative definition of taxable income called Alternative Minimum Taxable Income (AMTI). The taxpayer then needs to pay the higher of the two.

This parallel tax income system requires high-income taxpayers to calculate their tax bill twice: once under the ordinary income tax system and again under the AMT. The Alternative Minimum Tax (AMT) was created in the 1960s to prevent high-income taxpayers from avoiding the individual income tax. 2017 Personal Exemption Phaseout Filing Status 2017 Pease Limitations on Itemized Deductions Filing Status PEP will end at $384,000 for singles and $436,300 for married couples filing jointly (both will increase from 2016), meaning that taxpayers with AGI above these limits will no longer benefit from personal exemptions. The income threshold for both PEP and Pease will increase from last year to $261,500 for single filers and $318,800 for married couples filing jointly (Tables 5 and 6). House Representative Donald Pease) phases out the value of most itemized deductions once a taxpayer’s adjusted gross income reaches a certain amount. PEP is the phaseout of the personal exemption and Pease (named after former U.S.

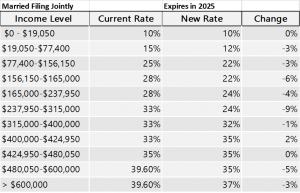

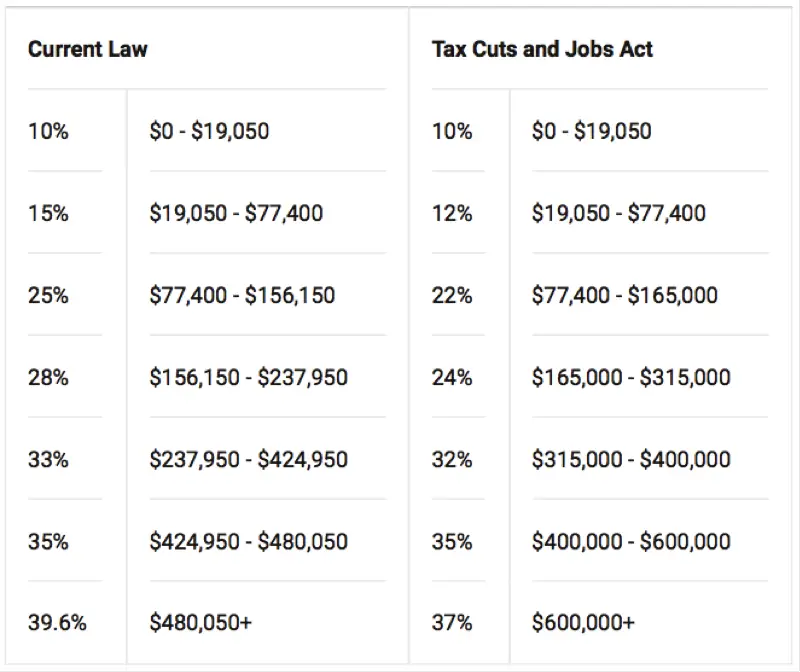

Current tax brackets code#

PEP and Pease are two provisions in the tax code that increase taxable income for high-income earners. 2017 Standard Deduction and Personal Exemption Filing Status The personal exemption for 2017 remains the same at $4,050. The standard deduction for single filers will increase by $50 and $100 for married couples filing jointly (Table 4). Standard Deduction and Personal Exemption

Head of Household Taxable Income Tax Brackets and Rates, 2017 Rate Married Filing Joint Taxable Income Tax Brackets and Rates, 2017 Rate Single Taxable Income Tax Brackets and Rates, 2017 Rate The top marginal income tax rate of 39.6 percent will hit taxpayers with taxable income of $418,400 and higher for single filers and $470,700 and higher for married couples filing jointly. In 2017, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Table 1). Launch Now Estimated Income Tax Brackets and Rates

0 kommentar(er)

0 kommentar(er)